Our wannabe Wolf of Wall Street attempts to strike it rich with the volatile exchange rates.

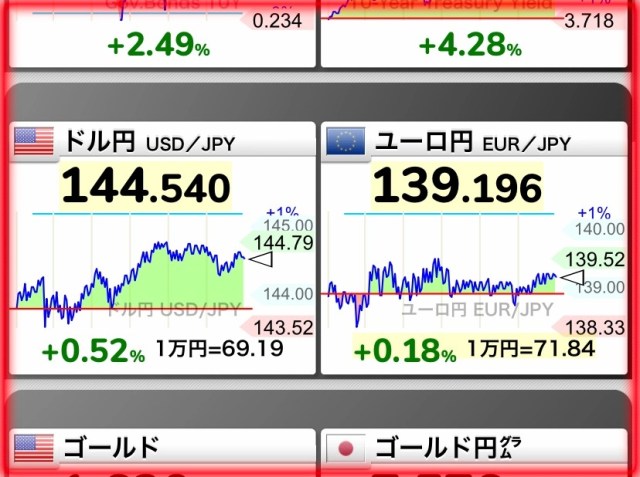

The Japanese yen is pretty weak right now, with current rates being close to the lowest they’ve been in a long time. In fact, the yen got so weak that the government intervened in the foreign exchange market for the first time in 24 years. On September 22, the Bank of Japan decided to sell U.S. dollars and bought Japanese yen in order to increase the value of the yen, and as a result the exchange rate was pretty shaky.

After the Bank of Japan’s announcement, the exchange rate dropped from 145 yen to the dollar to 142 yen to the dollar in an instant. But while the uncertain volatility of the yen’s value might seem nerve-racking to some, our Japanese reporter Seiji Nakazawa saw the stormy seas of the foreign exchange market as an opportunity to make some quick bucks.

“If I bought some U.S. dollars at the current exchange rate and converted them back into Japanese yen once the exchange rate goes back up, I’ll end up with more money than I started with!” Seiji thought, and armed with a 10,000 yen bill, he made his way to his local bureau de change.

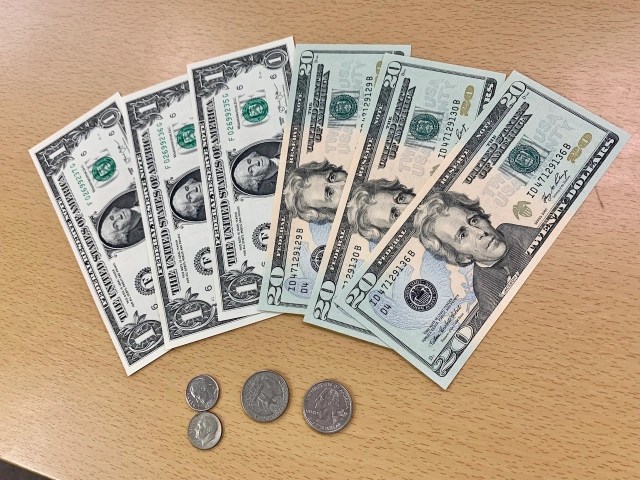

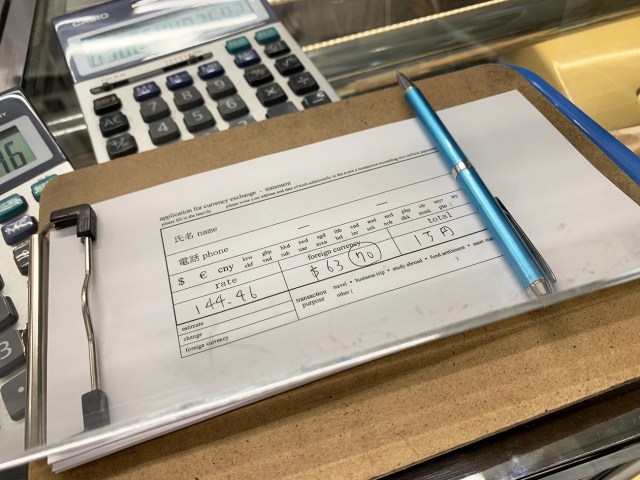

Seiji managed to arrive at the currency exchange mere minutes before it closed for the day, and the rate was 141.935 yen to the dollar. His 10,000 yen was exchanged for 63 dollars and 70 cents.

Seiji is no financial guru, but he predicted that the yen wouldn’t fall much lower than what he’d bought his at, and sure enough the very next morning the yen started to weaken, increasing over the weekend and eventually going back up to 144.540 yen to the dollar.

With an extra three yen for every dollar, Seiji’s initial ‘investment’ of 10,000 yen was sure to come back with a profit once he changed the dollars back into Japanese money!

… except he only got 9,261 yen, giving Seiji a net loss of -739 yen!

Seiji’s dreams of becoming a currency-exchange-born millionaire came crashing down harder than the exchange rate itself. How did this happen? He should have been making an extra three yen for every dollar he’d exchanged!

The issue was with Seiji’s initial exchange into U.S. currency. If the exchange rate was 142 yen, then 10,000 yen should have been equal to about 70 dollars, but Seiji only got 63 of them. After further investigation (and asking the clerk), it seemed that the money exchange Seiji had visited was offering 144.46 yen for every dollar — much different to the exchange rate listed in the news!

It was at that moment Seiji learned that the foreign exchange rate offered in banks and bureaux de change were completely different to the foreign exchange market rates often reported on the news. Coincidentally, it was around the same time that he learned that the exchange rates differ depending on the money exchange offices.

On top of that, while the yen to dollar rate was around 142 yen, the dollar to yen rate hadn’t changed, and was still around 144 yen per dollar!

All in all, Seiji’s attempt to get rich quick from taking advantage of the currency exchange didn’t go well, and his dreams of being the next Wolf of Wall Street were over as quickly as they formed. Still, he definitely learned something about the foreign exchange market; although exchange rates fluctuate a lot, it’s hard to predict what will happen.

Seiji will just have to try getting rich the old fashioned way — by re-selling cheap hats bought on Amazon.

Photos ©SoraNews24

● Want to hear about SoraNews24’s latest articles as soon as they’re published? Follow us on Facebook and Twitter!

No hay comentarios:

Publicar un comentario